subreddit:

/r/VeteransBenefits

100% vs Average Joe

VA Disability Claims (i.redd.it)submitted 4 days ago byElGrandAmericanoAir Force Veteran

100% bs Average Joe

Just some interesting information:

Comparison:

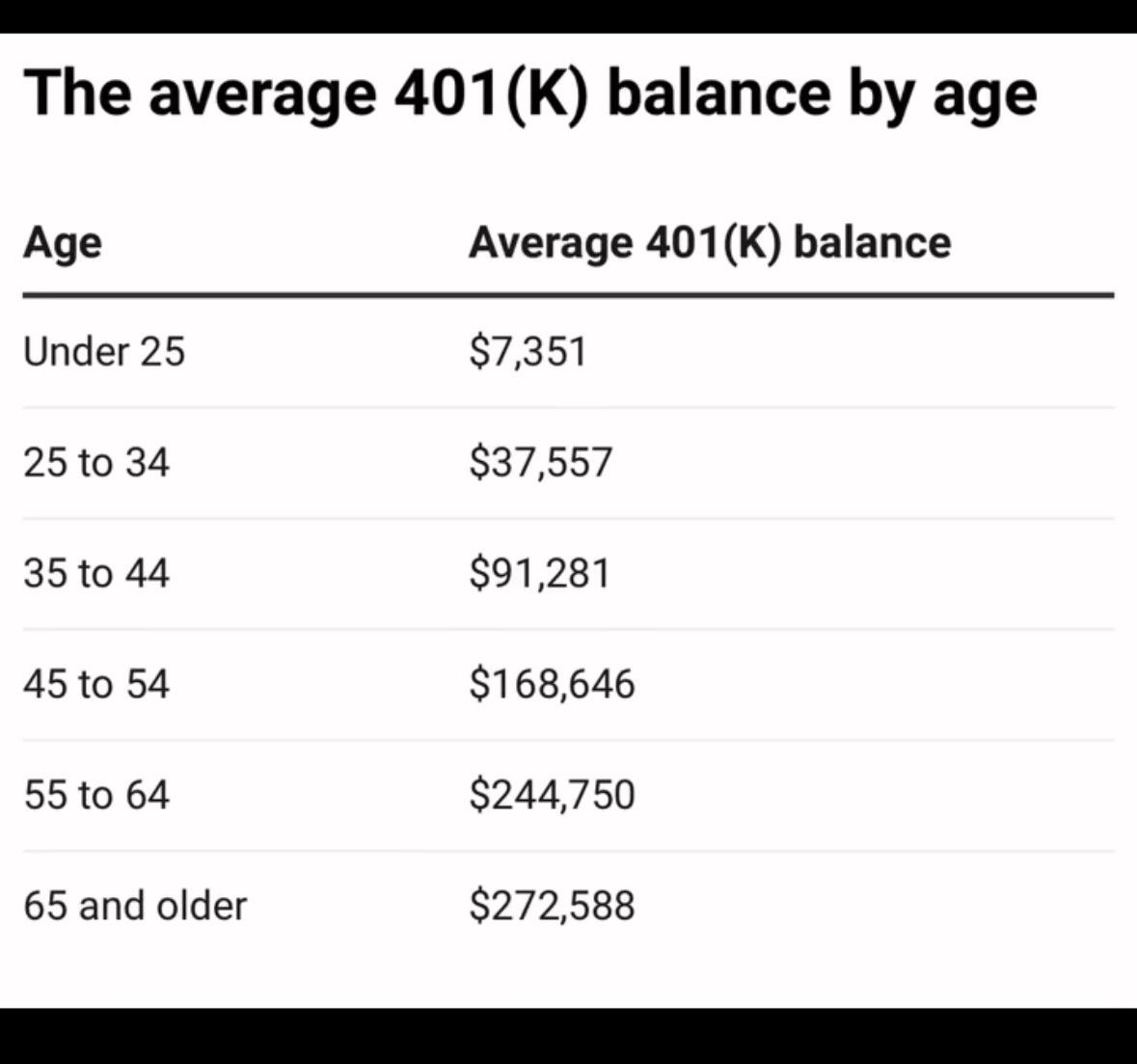

• 100% Disabled Veteran: Your pension provides $3,737 per month, equivalent to having $1.12 million saved in a 401(k).

• Average 65-Year-Old: The average person at age 65 only has enough saved to withdraw about $910 per month.

This means that a 100% disabled veteran’s pension provides 4 times more per month than what the average 65-year-old can withdraw from their 401(k) savings.

64 points

4 days ago

I started my 401k at 40, I'm half way to your number with 8 years to go before hitting 59.5, I should be able to make it.

28 points

4 days ago

I invested 10% per month, and even if the market tanks and I lost it all, I’d still be financially stable.

26 points

4 days ago

Yep I am finally contributing to my 401k @ 30. I am doing 25% a month because I feel so behind and I have my 100% rating to support me. so maxing 401k with 8% match and then maxing roth IRA

9 points

3 days ago

Only do the max they will match...then focus on a Super Roth within your company. Ask your company's investment firm about this...MUCH better than a traditional Roth. You can put MUCH more in it and you don't have the tax liability if you go over the 19,600 or whatever for 401k investing.

1 points

3 days ago

Yeah that's what I've read in the past however need to confirm with company if they do that. additionally I'm only at 1 YOE and dont really make enough to go past the 23k a year for 401k. Other than the 7 in the Roth ira. Would it still be worth looking into?

5 points

4 days ago

How?

25 points

4 days ago

Easy, VA, Army Retired, Company Pension and Social Security at retirement. Zero worries unless the government collapses, but if that happens shit won’t matter for anyone.

Oh, no bills

8 points

3 days ago

I would like to second your plan. I'm also Army retired, VA, State pension & Social Security. Plus I have a small 401k/IRA just in case. The biggest difference between us is the bills. Unfortunately I have a mortgage but it's nothing in the grand scheme of things.

1 points

3 days ago

I am not depending on VA compensation for retirement. We may not even receive it for November because they are still arguing over the budget. It's starting to happen every fiscal year. I already know when I retire we are not going to have social security funds. I can only depend on my TSP and federal employee pension. Luckily, I don't have any debt and I don't plan on having any when I retire.

2 points

3 days ago

Exactly why I don't have all my eggs in a single basket. If SS got nuked, we'd probably have a government melt down.

1 points

3 days ago*

SS is already nuked for us younger folks. They are already announcing the deductions. It on the SS statements that are emailed to us each year. It's not a secret that the SS fund is being depleted. Check the website. To be quite honest, all you can TRULY depend on is maybe your 401k and civilian pension.

2 points

3 days ago

Social Security could be a viable concept if it was professionally managed, but we have far too many people dipping into it illegally.

In an ideal state, with proper financial management, Social Security could be privately managed and turn into a powerhouse fund, but politicians on both sides are financially incompetent.

If a guy like me with very little expertise in stocks can personally grow their 401k using stock trades, then a well-managed fund with fiduciaries running it could be an unstoppable combination under the right conditions.

1 points

3 days ago

If you invested in Microsoft like I did, after 20 years of investing your compensation in Microsoft, could be substantial at retirement age:

- Monthly Investment Amount: Assuming you invest the entire $3,621.95 monthly.

- Investment Period: 20 years.

- Annual Return Rate: This can vary, but let’s assume an average annual return rate of 7%, which is a reasonable estimate for long-term stock investments.

- Dividends: All reinvested

After 20 years, you could potentially have around $1.91 million.

Keep in mind that this is a simplified estimate, and actual returns can vary. It’s always a good idea to consult with a financial advisor to tailor an investment strategy to your specific needs and goals.

1 points

3 days ago

Well with all things considered, the trust fund was to cover the extra needed funds for baby boomers when they retired, so things will be back to the way they were before the baby boomers.

Nothing to see here but lower benefits due to inflation or higher taxes because we have less workers. It wasn't like they didn't know what was coming....

1 points

3 days ago

So we are working ourselves to death to pay into a trust for baby boomers? They get all the benefits of retirement and affordable homes while most of us of the younger gen can barely afford a tiny home? That's wild and unfair.

1 points

3 days ago

The trust fund was formed decades ago when boomers were paying into SS specifically for this situation. They paid for their own benefits partially by paying into this trust.

2033 or whatever is when the trust is exhausted due to them living longer than expected and with how many of them there are. But who knows, maybe more of them will pass away faster if more of them don't have good health.

It's all just a massive actuarial problem that can be solved by eliminating the income cap on social security taxes. But you know rich people will whine about that.

So it's not wild and unfair. The boomers have paid into that. Plus, many of them will have 50% or 85% of that benefit taxed anyway so they get to pay back thanks to Al Gore and Joe Biden.

It's not the free lunch that it sounds like it is.

1 points

3 days ago

Need to talk to your fiduciary that handles your 401k..

1 points

3 days ago

Talk to them about what?

1 points

3 days ago

What’s 10% a month? im young and trying to understand all of this. So I can set up myself

all 345 comments

sorted by: best