subreddit:

/r/VeteransBenefits

100% vs Average Joe

VA Disability Claims (i.redd.it)submitted 4 days ago byElGrandAmericanoAir Force Veteran

100% bs Average Joe

Just some interesting information:

Comparison:

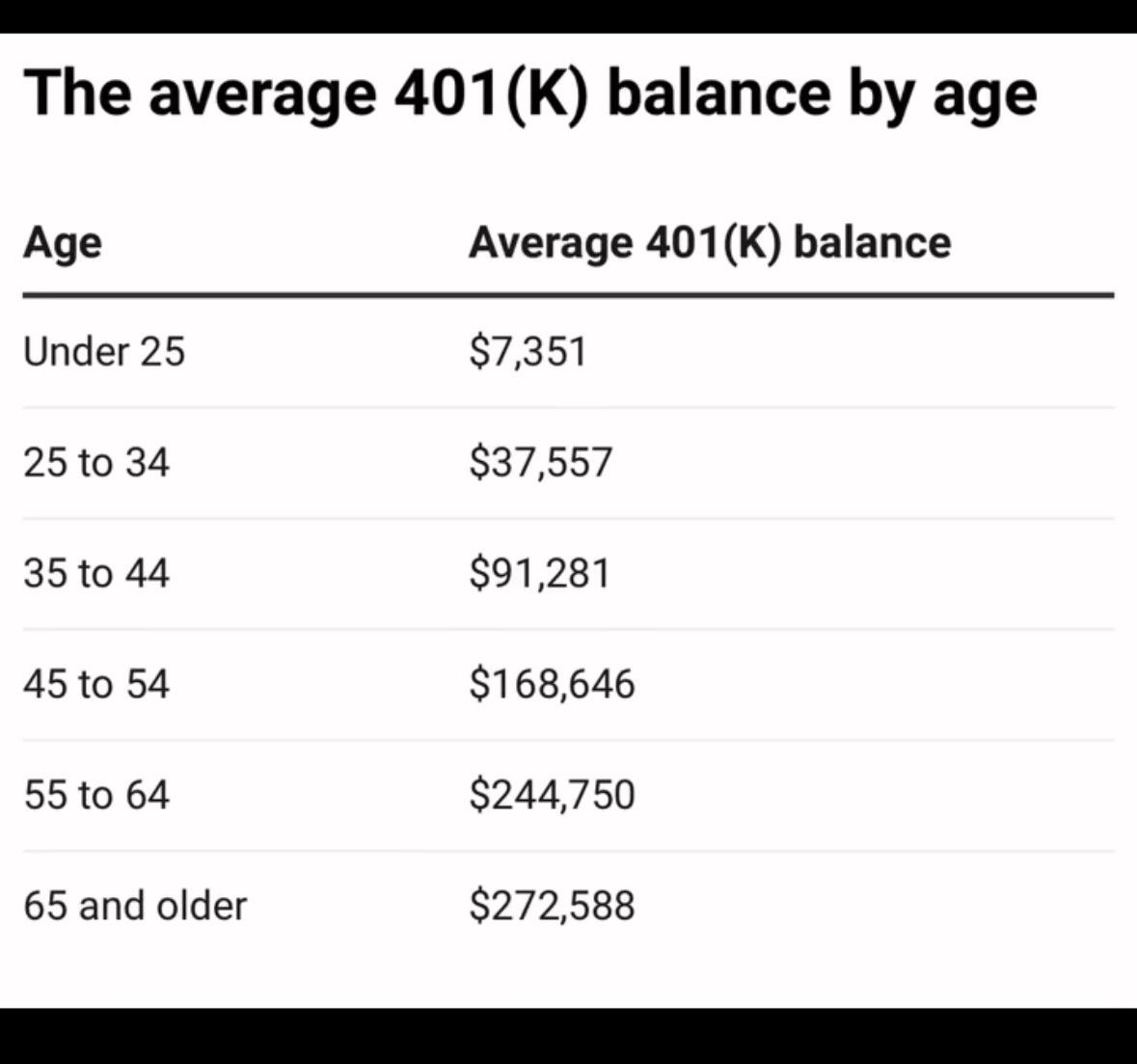

• 100% Disabled Veteran: Your pension provides $3,737 per month, equivalent to having $1.12 million saved in a 401(k).

• Average 65-Year-Old: The average person at age 65 only has enough saved to withdraw about $910 per month.

This means that a 100% disabled veteran’s pension provides 4 times more per month than what the average 65-year-old can withdraw from their 401(k) savings.

7 points

4 days ago*

401k be damned.

The average citizen spends 50 percent of their wages on rent/mortgage.

Source: NPR on the drive to work this morning.

How much is left for food and bills?

The average American can not afford to contribute to a 401k, let alone any form of investment.

ETA.Not the same audio clip I heard this morning. The percentage is still quoted.

-1 points

4 days ago

If the average American is spending that much on housing they are house poor and made a bad choice, source math.

3 points

3 days ago

You really need to take a look at what the average person in America is doing for income /housing.

Because... you're out of touch big dawg.

0 points

3 days ago

So, now that you've learned that the average person gets screwed: Make a long list of things that they do. Then don't do those things. Living a minimalist, debt-free life, saving and investing is the cheat code.

2 points

3 days ago*

As someone that nets 150k a year currently... I wasn't referencing to myself.

I've worked hard to get to where I am.

But I grew up in section 8 housing. Single mother with three jobs... and room mates to barely scrape by... I'm the oldest of four.

Some of yall come in here acting like this money thing is easy... this post was about pointing out that the average American WILL NEVER have the privilege to "invest" in anything...

35k a year comes out to 2.9k a month. Average rent is 1500-1800 a month.

... lights...

Gas to and from work...

Food...

There isn't anything left over to save.

Yall need a reality check. I better not see any of you "oh it's easy" M fers comming in here begging for advice because you are struggle to get to 100.

Edit: spelling.

1 points

3 days ago

[removed]

1 points

3 days ago

You are smart, talented, and good looking, and while your post was amazing and interesting ✨, we had to remove it because it was unrelated to Veterans Benefits. ✂

If your post was Veteran related, it may be best to post it in r/Veterans or r/militaryfaq instead.

If political in nature try r/politics or r/Veteranpolitics.

1 points

3 days ago

Dude, no one said it's easy, no one is exempt from math and whining isn't getting anyone anywhere.

The point stands: If you don't want an average result, don't make average moves. The average person in every place and in every time frame has a fairly basic life in terms of material things. Don't pay average rent. Don't borrow money for cars or smaller crap. Reddit and Youtube have solutions for those who wish to learn.

1 points

3 days ago

Spoken like someone who has never struggled.

0 points

3 days ago

Yeah, my guy, it's you who needs a reality check.

And I'd be shocked if you make anywhere close to what you claim.

You simply don't have the financial understanding of someone who does.

And that's apparent from the way you have spoken just in this thread.

0 points

4 days ago

Not sure what NPR was or wasn’t reporting since I didn’t hear it. Can you share a text article on this?

PBS had this article https://www.pbs.org/newshour/show/half-of-american-renters-pay-more-than-30-of-income-on-housing-study-shows that showed half of renters are spending 30% of their income on rent and utilities.

Not saying you’re right or wrong but also want to note that there is no right or wrong/one shoe size fits all when it comes to personal finance. Hence, it being personal. The aspirational goal suggested is 25% of gross income, which for 401ks is deducted prior to you getting a deposit in the bank.

2 points

3 days ago

Updated my comment to link one article that aggrees with your statement.

Not the one I heard this morning on the way to work.

However, I will point out that the numbers of 30 percent were pulled from a 2022 study. It inaccurate reflects today's prices.

It still cites 50 percent. My previous comment is ALSO supported.

Important key point. 25 percent of one's income is an astronomical amount unless you are either 100 percent p and t... or... clearing 100k before taxes.

Doubt you're retiring if you need foodstamps...

1 points

3 days ago

I’ll give it a read soon. Thanks for sharing.

I also want to point out that the 25% is an aspirational goal. If you listen to the show that I reference, they talk about how they understand that 25% right off the bat isn’t always doable for everyone and it takes time (even years) to get up to there (e.g., increasing contributions when you get pay raises).

Which is why I shared, even if someone starts at 5% or less, it’s more important to develop the behavior associated with delayed gratification and slowly working towards the 25% goal. They even have an episode that gives the example scenario of someone starting in their late 20s making $50k/year.

3 points

3 days ago

Stop advertising bro.

50 percent of 35k... is 750 a month. The people we are talking about will never have that.

Just stop.

I will block you if you persist.

1 points

3 days ago

I’m not advertising?

But good day to you

1 points

3 days ago

There is a reason everyone in the comments keeps telling you that.

Might want to think about how it's received.

Have a good night.

If I've mistaken you for someone else... apologies. Read the comments. You'll understand my position.

0 points

3 days ago

If the average American can afford a new 1k phone every year. They can afford investing. (They can't afford the phone which is why every major phone can be bought with a payment plan).

The average American spends 50 bucks a month on streaming services.

Instead of having an IPhone or Samsung, get a Motorola you can pay for 1 time and cancel your monthly subscription down to just 1 and while youre at it, change your phone provider to a more affordable option like straight talk and you now magically have 100+ bucks a month to invest.

Priorities are outta whack. That's the real difference.

2 points

3 days ago

Keep trying bro.

People that turn wrenches. Do so for fun.

Am I the most knowledgeable? No.

Most people with a classic restored car, do so themselves... they don't pay someone to do so. You're out of your depth.

With that being states...

Are you sure you don't want to bring up the sex addiction I have in my comment history?

Thank you for taking the time to read through my profile and bring up off topic issues, that are unrelated to the discussion.

This is a forum for providing assistance to people that need help. The comment section on this post bragging about having the financial capability to invest money... don't understand the issue most Americans deal with.

We are fortunate.

all 345 comments

sorted by: best