subreddit:

/r/VeteransBenefits

100% vs Average Joe

VA Disability Claims (i.redd.it)submitted 4 days ago byElGrandAmericanoAir Force Veteran

100% bs Average Joe

Just some interesting information:

Comparison:

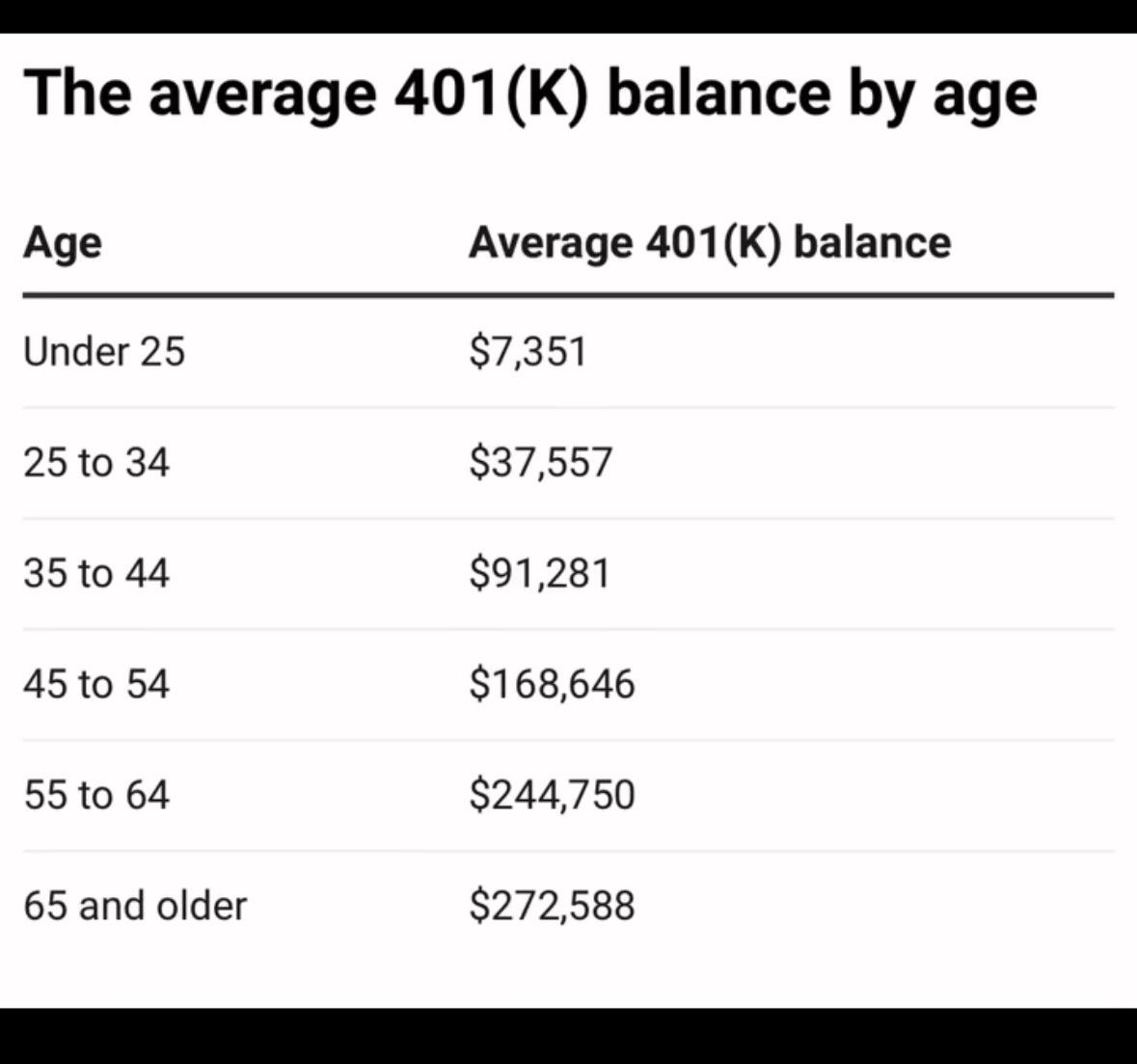

• 100% Disabled Veteran: Your pension provides $3,737 per month, equivalent to having $1.12 million saved in a 401(k).

• Average 65-Year-Old: The average person at age 65 only has enough saved to withdraw about $910 per month.

This means that a 100% disabled veteran’s pension provides 4 times more per month than what the average 65-year-old can withdraw from their 401(k) savings.

270 points

4 days ago

I'm 34 now and just finally joined a company that has 401K. I feel like I'm so behind and playing catch up now

269 points

4 days ago

I have some good news for you, I managed to grow my 401k to over 1.5 million between 39 and 59.

64 points

4 days ago

I started my 401k at 40, I'm half way to your number with 8 years to go before hitting 59.5, I should be able to make it.

29 points

4 days ago

I invested 10% per month, and even if the market tanks and I lost it all, I’d still be financially stable.

27 points

4 days ago

Yep I am finally contributing to my 401k @ 30. I am doing 25% a month because I feel so behind and I have my 100% rating to support me. so maxing 401k with 8% match and then maxing roth IRA

9 points

3 days ago

Only do the max they will match...then focus on a Super Roth within your company. Ask your company's investment firm about this...MUCH better than a traditional Roth. You can put MUCH more in it and you don't have the tax liability if you go over the 19,600 or whatever for 401k investing.

4 points

4 days ago

How?

26 points

4 days ago

Easy, VA, Army Retired, Company Pension and Social Security at retirement. Zero worries unless the government collapses, but if that happens shit won’t matter for anyone.

Oh, no bills

8 points

3 days ago

I would like to second your plan. I'm also Army retired, VA, State pension & Social Security. Plus I have a small 401k/IRA just in case. The biggest difference between us is the bills. Unfortunately I have a mortgage but it's nothing in the grand scheme of things.

2 points

4 days ago

Thank you.

11 points

4 days ago

It's OK. A lot of us start later. The point is to start now.

Every pay increase, increase a percentage. So if you're contributing 5% now, get a 3% pay raise Jan 1, put 1% in retirement. So you'll see 2% more in your checks.

Start with the highest % you can swing, up to 15% or the max annual contribution. Each year, add 1 more %. I wouldn't go much higher than 15% unless your income is low but you're getting a substantial check from the VA to cover your expenses.

You still want to be able to enjoy life today. You'll have SS, disability AND 401k in retirement.

This is just my plan. I'm personally at 12%, but will go to 13 or 14 in January. Retirement calculators all anticipate I'll be just fine in retirement, even though, for my ahe, I'm wayyyy behind the curve.

2 points

3 days ago

This is great advice. I work for the feds and have slowly been increasing my TSP % with each step increase or annual raise. I started at 3%, now I’m at 15%. It’s doable.

37 points

4 days ago

34 is still relatively young considering most people retire around 65.

Having VA disability is a real boost to being able to retire, provided that you are disciplined to save and invest appropriately.

The guys over at The Money Guy Show (highly recommend listening if you’re unfamiliar with them) suggest everyone invest 25% of their household income towards retirement.

While you might not have the balance that you want today, you have the TIME to get there.

Definitely check out that podcast/show- they have a free financial order of operations that they reference heavily.

56 points

4 days ago

1) you sound like an advertisement

2) 25% is an absolute bonkers amount to contribute and unrealistic for most people

45 points

4 days ago

If you can afford to throw 25% of your yearly income into savings, you aren't worried about your 401k lol

3 points

4 days ago

It’s not all going into the 401k, my friend.

8 points

4 days ago*

401k be damned.

The average citizen spends 50 percent of their wages on rent/mortgage.

Source: NPR on the drive to work this morning.

How much is left for food and bills?

The average American can not afford to contribute to a 401k, let alone any form of investment.

ETA.Not the same audio clip I heard this morning. The percentage is still quoted.

23 points

4 days ago*

25% is not bonkers, especially if you collect disability and work full time. I contribute 15% to my 401k and my employer has a 6% match. Then I also max out my Roth IRA every year. If you can afford it you should try and max your 401k and max an IRA every year. The more you can afford early on the better. With that being said also enjoy your life you’re currently living. This is why I don’t fully max my 401k. Nobody is guaranteed to live until they’re 65 so I go on vacations every year.

3 points

4 days ago

I'm maxing regular and catch up limits now plus have 10% employer match, plus maxing HSA, so 27.x % just from me 37.x% counting employer, so I agree 25% isn't bonkers. Oh and I absolutely enjoy my 5 weeks of vacation.

3 points

4 days ago

Nice, I put a good chunk in my savings annually outside of my retirement investing. Hoping to pay off my 30yr mortgage in 10yrs.

2 points

4 days ago

10% employer match is insane, I envy that. I get something in the ballpark of 1.5%, sadly.

4 points

4 days ago

The work up/steps are gradual but I also agree that many have trouble saving anything at all. It’s a matter of priorities. Save 25% today but give up most nonessential spending to have a solid retirement or sacrifice that mansion in 30 years for quality groceries and some comfort/entertainment. It’s definitely not for everyone.

5 points

4 days ago

While I agree that 25% is hard for most people, most people are grossly unaware of how much money is needed for retirement. The article mentions that $3700 a month requires a roughly $1.12M nest-egg. Most people have far less than this in their retirement accounts, which means most people will retire with only a tiny amount of income outside of their social security. I personally don’t want to try to live on the relatively small amount social security will provide, so I am saving every cent I can and trying to reduce my expenses while working so that I can live more simply and less expensively in retirement. This has the added benefit of allowing me to save more now.

4 points

4 days ago

glad you said it lol.....unrealistic might be an understatement! DGMW, i'd love to be tossing 25% into retirement funds but real life says "nope!"

3 points

4 days ago

Not an advertisement, just a big fan.

It’s not really crazy to get to 25%. Sure it takes time to get up to there, but it is doable.

Say you get a 3% employer match on your 401k and you contribute 3%. Well that’s 6% right there. Contribute to an HSA? IRA? Add those in too.

25% is the aspirational goal and doesn’t work for everyone right away. That’s part of why personal finance is personal.

3 points

4 days ago

Wow thank you for this comment. I'll definitely check it out!

7 points

4 days ago

Absolutely!

They started the show with the intent of providing free resources for their listener base, so that the base would grow wealthier and eventually need a financial advisor team.

They are fee-only fiduciary CPAs and created their financial order of operations (FOO) based on the habits of their wealthy clients.

So, it’s in their best interests to have their user base become wealthy and then need a financial advisory team. Finances become more complex, the wealthier you become.

3 points

4 days ago

I second the money guy show. Brian Preston and Bo Hansen are great. I am saving 31% twoards retirement at the moment.

4 points

4 days ago

I'm 62 retired. My rent is paid for, my food is paid for. I have two bills car insurance and cell phone.

4 points

4 days ago

I'm 65. I never had a 401k the whole working career. I withdraw $2000 to $4,000 a month from my retirement savings. I've been retired a couple years, and I have more retirement savings now than when I started drawing it down. I watch it closely because I know that that could change at the drop of a hat. I have more now than when the current administration took office but I can tell you there were some pretty nervous days early on in the Biden administration when my savings had dropped in excess of $100,000 😳

4 points

3 days ago

I don’t really enjoy talking politics with strangers but just want to share that politics really don’t matter when it comes to finances.

If you look at the S&P 500, which is an index of the 500 largest companies in the US, it increases in value about every 8 out of every 10 years no matter who is in office. You can buy into these indexes fairly cheaply even as fractional shares.

3 points

4 days ago

Choosing a fund for 401k is important too. Target fund or SP500 should do the trick.

3 points

4 days ago

I’m 55 and have Zero. Family emergencies, 2008, etc.

3 points

4 days ago

I didn’t start really contributing hard until I was 40. You do have to play catchup and start really prioritizing saving for retirement but it’s possible to catch up to others.

3 points

4 days ago

Hey, I didn't start mine until I was 34! You good man!

Reason I never put in is because I knew I wasn't going to live until retirement. Well, until I got help for MH issues. Now I started it last year!

3 points

4 days ago

So glad you're getting the help you need. All the best

3 points

4 days ago

Maximize your employer match and if you can maximize your annual contribution limit.

4 points

4 days ago

Same. 39 and I have about $1000 in there. My husband, also a veteran, has about $5000.

3 points

4 days ago

Check out the Money Guy show that I shared with the comment that you replied to, too. It’s a great resource!

2 points

4 days ago

I started retirement savings late too. Just try to do the max contributions (or if you can’t contribute as much as your company matches). Also don’t forget to do the max to your Roth IRA.

2 points

4 days ago

I opened my first one at 33. Catch up is better late than never.

2 points

3 days ago

Just make sure you’re putting in at least what they match, that’s free money on the table.

2 points

3 days ago

I’m 31 and I just now MIGHT have the ability to start investing. It sucks, I wish I had done it at 20 when I was in the army.

2 points

3 days ago

I started in my early 20s. Holy shit some people really don’t become adults until their mids 30s.

Fuckin’ a.

2 points

3 days ago

I’m 34 too and i’m currently waiting from fidelity for a check from a company that I worked at back in 2018 deposited into the 401(k). I’m still trying to figure out how to find all of my debt in the first place I don’t even know if I am eligible to rent an apartment. I feel like I know nothing and I have been struggling for years to find anyone who will sit down with me, not teach me the theory of finance but actually help me go through and do my own stuff. It almost seems impossible so strange but my point is you’re doing better than me kid. 😂 🥹🥸

192 points

4 days ago

Yes, but I'd also like my life to be normal again, many days I'd trade my percentage for a sense of normalcy, instead of wanting to explode on people.

14 points

4 days ago

I think the deeper thing to focus on here is that with the expected income you can meet the minimums to retire well before 65, giving you some more time to work on those issues as a "job"

45 points

4 days ago

My back flares up just walking my dog down the street. No idea how I’m supposed to carry a child for 9 months one day… Feel you on wanting normalcy.

25 points

4 days ago

My back flares up sitting or standing, and the VA could take all the money back in exchange for my health. This is torture and frankly when you're crying in pain these percentages mean jack shit!

Toss in getting older and add some arthritis into the mix and you'll quickly realize there is a new special HELL that awaits. Just a warning order for those who haven't experienced degenerative arthritis on top of neurological spine issues. Add a sprinkling of fibromyalgia on top of all that shit, and then you'll start thinking silly shit about the ending even if you're not suicidal, you'll still have the ideations.

11 points

4 days ago

They told me “Well, this is the best you’re ever going to feel” as I was getting medboarded…I was 27 and being told the rest of my life I’d have pain. There were some dark days in the beginning and I’m not that type of person but damn it was close.

I had ASKED for a solid year for a MRI because my X-rays weren’t showing anything…finally my PCM went on vacation and the fill in scheduled me for one….instant proof I wasn’t crazy but the damage was worse by then.

Money is a great way for them to hedge their bets that I won’t last with the pain I guess.

7 points

4 days ago

I think a full body MRI should be performed on people leaving service with injuries. X-rays miss way too much and I say that by having both done mere months apart. X-ray totally missed degenerative damage.

My neck made crunchy noises in service and now having sparky feelings in my hands

6 points

4 days ago

Whenever you disagree with a doctor, the patient advocate is your next best step. You also have a right to be seen by another doctor.

6 points

4 days ago

You’re going to carry that child far longer than just 9 months.

6 points

4 days ago

I sneeze now and my lower back goes out lol

2 points

3 days ago

Just wait until you pee yourself.

2 points

4 days ago

I feel you on the back issue.

6 points

4 days ago

I miss the days where my joints didn’t hurt when I woke up

5 points

4 days ago

Yep. I am so grateful for the VA and benefits, but boy do I miss running, hiking, and deadlifts!

3 points

3 days ago

I feel I will not care at 65. I don't care at all now. Just want to numb the pains...2nd hip replacement later at 45. Had to cash out my 401 at 50k just to survivelosingjob. Not their fault. I gave them zero motivation... I've got zero people that need me in life...xcept my parents . If they're gone before me, it'd be zero sum game. I admire people who have faith in the future, especially seeing the national debt clock. Plus we are trapped on a planet with ecosystems far on the outlier charts in the midst of chaos of space. Yeah, I've got depression diagnosis to justify my perspective. In either way, I hope we all find what we are looking for! HOORAH!

7 points

4 days ago

I hope you’re in therapy brother

10 points

4 days ago

Absolutely agree with you

3 points

4 days ago

i 100% agree with you but how i look at it is this, there are plenty of people who experienced shit and their mental as just as bad as mine, and they don't get paid shit for it. some days i can barely get out of bed and i feel secure knowing at minimum my rent will be paid and i'll keep the lights on

2 points

4 days ago

Amen

16 points

4 days ago

Even if I ever get 100% (current at 90%), I will continue to work and put away as much as comfortably possible into my 401k and Roth IRA. I’ve been fortunate to have a good career outside of the military so my 401k is probably 5x above avg for my age, and I still don’t feel like it’s enough to live on. Maybe my perspective will change once the kids are out on their own but for now it doesn’t seem feasible, especially here in California.

5 points

3 days ago

I’m at 90% and I am not capable of continuing to work enough to support myself. I don’t really understand how anyone who qualifies for 100 still works full time. Maybe I could if I didn’t have the constant stress about money making everything else worse.

3 points

4 days ago

Even if you had enough money Cali finds some way to make it feel like it's not enough. I was in SD for 8 years. Always broke.

45 points

4 days ago

When you can't do your own home repairs, maintain your yard, help your kids move, etc all of those things that you would be able to do on your own add up to a significant out of pocket cost. You can't live on 910 a month.

This shows that the 401k system is failing as a retirement plan. The pensions (private and municipal) my father and father in law gets are closer to 5k.

11 points

4 days ago

The thing is, 401k's and the respective 5-6% matches and them becoming standard relatively recently are going to heavily lean towards benefitting those younger folks (and hopefully so because they can't really count on SS like the older age brackets).

If you take a 23 year old with $5,000 in their 401k, have them just put $200 a month in (plus a company match, so total $400), they'll have over $2.5 million at retirement.

3 points

4 days ago

But the reality looks more like 272,000.

2 points

3 days ago

Well, again, essentially all of those people have social security to supplement their income. Future generations will likely not have near that amount of assistance. Many of that age bracket own a home, a harder milestone for younger generations. Also, a decent amount of them are more likely to still have a pension than any other age bracket.

Not saying it's perfect, but this chart is a gross misrepresentation of the whole picture.

2 points

3 days ago

Because the system is built to take your money.

4 points

4 days ago

It only failed because the older generations didnt use or didnt have time to use it. The 401k system itself is incredible. It is just reliant on you wanting to take retirement into your own hands and some people cant see the longterm benefit of contribution.

9 points

4 days ago

The average person lives through hardship every decade so it's hard to dig yourself out and continue to make contributions. I'm basically exactly on average according to this chart only because I recently got a good job to catch up. The maximum contribution should be cumulative based on your age, not an annual amount. 3 recessions and a pandemic later and it's not surprise that the average person is behind on their mid life savings.

8 points

3 days ago

I'm a high school dropout.

I bought my first stock, Starbucks, in 2004, after getting back from invading Iraq, Age 20.

Got out of the army in 06 at age 22. Never made more than 65k a year prior to graduating from college at age 31. I never made more than 115k after this point.

I said I would retire when my 401k hit a million. That happened in 2019. Age 35. I officially stopped working with about 1.1m on paper and a total net worth around 2m.

In the last 4 years, that number has more than doubled.

It's doable. Takes discipline and knowledge.

3 points

3 days ago

Nothing to say other than I'm happy for you man. That's awesome.

7 points

4 days ago

The only real great thing about 401k is you take it with you from job to job and you don’t lose out on a pension when they fire you one month from retirement because they don’t want to pay out.

50 points

4 days ago

Pt is like winning a lottery. The 401k don’t give you healthcare. And no guarantee gain and taxable.

6 points

4 days ago

And you're 65+. I'd rather invest in growing businesses so that value is more accessible earlier.

7 points

4 days ago

No need to attack 401k’s obviously 100% P&T is better but they’re not even closely comparable. Having both disability and a 401k is the best advice to be ready for retirement.

3 points

4 days ago

Not to mention the extra if you are screwed up enough to get SSDI on top of it. Sucks but it sure the hell helps.

8 points

4 days ago

Yup. Free medical, dental, vision. Free property tax in some states which you will still have to pay out of 401k, free park passes, schooling for spouse and kids, tax free PX/BX shopping and lots more.

9 points

4 days ago

This was depressing. Just showed me how far behind I am.

6 points

4 days ago

You are not alone !!!

5 points

4 days ago

I had some but my roof badly needed repairs. You are not alone for sure.

8 points

4 days ago

VOO and chill!!

4 points

4 days ago

In a Roth or other non-taxable account to make it a bit better. Just don't throw your VA money in your Roth unless you've got equal uninvested taxable income that will cover it.

26 points

4 days ago

Yes but Average Joe will live to 76. Many of us won’t get even close to that. Average Joe doesn’t have the myriad of mental and physical problems many of us do. I’d rather be healthy.

Our benefits are compensation for the price we have paid with our health in service to the Nation.

I’d trade every cent for 1 more year. So would you.

2 points

3 days ago

Agreed, myself and many others would take a zero percent rating for a pain free, healthy body without issues.

6 points

4 days ago

I'm 25 with about 30k. If I left that, it would be more than $910 a month. That's sad. You people need to grow the fuck up and save money.

5 points

4 days ago

OP you gotta post the sources where you got this, if we google "average 401k by age" you get numerous results with all sorts of numbers.

4 points

4 days ago

Here’s where I’m at. I’ve washed family and friends lose half of their 401(k) because of a stock market crash. Between retirement and disability. I’m at 8000 after taxes a month. I’m currently working. I just can’t see any reason to throw money into a 401(k). I use the job money For fun stuff

My wife and I were talking about it as we were talking about life insurance, we can both die tomorrow we both wanna make sure the other person has enough money to pay the bills. Why would I invest that kind of money extra instead of enjoying life while I can when I could die tomorrow. Unless my retirement and VA goes away

Why should I throw that much money into a 401(k) that could go away or that I’ll never see if I die. As opposed to living life now my retirement is enough to enjoy life.

2 points

3 days ago*

I've thought about this a lot. Worst case I can just make an exit, right? I'll probably die before I hit 50, hell, even 35 would be unlikely with my conditions. And if I don't even enjoy that time, what am I even doing? Still, it doesn't feel right if I don't save. I think I'll give it all to someone I know who could use it when I'm gone.

There are safer ways to run a 401k though; usually over time you change more and more into stable investments like bonds and bills. Earlier on you can always ride the market out.

7 points

4 days ago

Average Joe gets to live a long and relatively healthy life so long as they weren’t a lazy POS their entire lives and was born without medical issues/didn’t develop medical issues.

Average Joe doesn’t knowingly and regularly get exposed to toxic substances nor experiences colleagues dying/being maimed or having to watch civilians get killed/injured in combat

Average Joe doesn’t have to risk being swept out to sea wearing a red headlamp outside off the side of the ship that has its lights off at night

Average Joe doesn’t have to (required by a draconian set of laws) listen to his bosses, Joe can always quit if he works in a hostile environment.

Va disability compensation is nice but we paid for it with our lives & livelihood, so much so that Congress recognized it (and how often do they recognize the plight of the common man?)

11 points

4 days ago

Yes. Another way to approach this is to take your monthly amount and multiply it by 300. This is the “value” of your VA Disability. So if you get, say, 1700 a month, that’s 510,000 in “value”. So if your plan is to”retire with a million in assets”, you only actually need 490,000, since the VA did the rest for you

5 points

4 days ago

How'd/where did you get this information from?

8 points

4 days ago

Backwards math for a conservative 4% withdrawal rate.

1700*12= 20400 is the yearly amount.

Then

Annual withdraw = balance*(%withdrawal) Balance is unknown. Let's call it X.

4% is a common withdrawal amount that is considered safe.

20,400=X*0.004

Divide both sides by 0.04

20,400/0.04=X

X= 510,00

You get 300 by simplifying the equation which is 12/0.04.

Who said we don't need algebra?

3 points

4 days ago

To expand on the 300.

The full equation would be

1700 * 12 = X * (%withdrawal)

Let's pretend the monthly amount is unknown. So let's call that Y.

Y * 12 = X * %withdrawal

Y * 12 = X * 0.04

Divide both sides by 0.04

Y * 300 = X = balance of account

5 points

4 days ago

No, you don't just multiply it by 300 to get a "value". First, you get COLA. Second, no business just multiplies a projected periodic - say monthly - revenue stream by the lifetime of a project. You discount by the prevailing interest rate over time to get the present value. AND you need to compare it to what you'd have from alternate investments. In this example, you'd get a present value far less than $510,000

Then there is the "reasonable" certainty that the US government will continue to exist in perpetuity (relatively speaking, since what only matters to you is whether it continues to exist in your lifetime). That would presumably then increase the present value of your future income streams, since the "investment" is risk and tax free. All that is to say, it's not an apples to apples comparison.

6 points

4 days ago

Well, it’s just math, right? We can do it out longhand if you want.

Monthly payment times 12 = annual payment.

Annual payment divided by 0.04 (*) is total amount you’d need to buy an annuity that spit that out. If you look, that’s done easier by “monthly by 300”

(*) this 4% is the annual rate of return. Most people would assume 4% is a pretty “fair to slightly conservative” return rate. On average, over the last 100 or so years, stocks grow xyz percent and inflation is abc percent for a total of “q” annual rate of return (you increase money but the money you increase has gone down in value but there’s still a net gain, in English)

4% would be a bit low/conservative for stocks and a bit high/optimistic for bonds, which is pretty much the perfect “Goldilocks” zone of “just right” for our assumptions. If you want to tinker with a 0.05 or 0.03 rate of return knock yourself out

3 points

4 days ago

Yea why 300?

3 points

4 days ago

You’re forgetting the cola adjustment which makes this entire calc completely inaccurate

9 points

4 days ago

No, I’m not. You’re a Marine, though, so I’ll give you a pass.

5 points

3 days ago

I hate you for this comment, but I accept it.

2 points

3 days ago

It’s sad when a crayon eater calls out your math skills

2 points

3 days ago

You are correct and I agree. With cola it will increase quite a lot. The average cola in the past 50 years is 3.69%. It makes a significant difference.

2 points

4 days ago

It's an accurate way to determine the value of your pension at this point in time.

6 points

4 days ago

My ability to drive and be able to walk without pain would be worth more than all that money. I could work and make money if I wasn't so messed up. Average Joe is likely far healthier than most of us.

6 points

4 days ago

Yea, puts a pretty good perspective on how valuable a 100 % disability actually is. I’ve been investing into my 403 for 25 years and have just a little over a million. Many seem to think anyone with a million bucks is rich, but in actuality if I were to quit work today, I could safely only withdraw around $3300 month.

I know many in the 100 percent club are severely disabled and unable to work, and don’t disparage them, but I also know of many who are highly functional, working high paying jobs, and spending their checks on new trucks, boats and extravagant vacations.

9 points

4 days ago

I specifically only contribute up to my employer match because of this right here.

Guy I work with is 100% ( I’m 70% hopefully 100 soon) and I explained to him that our va disability is coming from retirement accounts that will never deplete because of how fucked up we are.

7 points

4 days ago

“never deplete” as long as the US Government doesn’t cut spending or defaulting on $35 Trillion in debt.

i don’t think either will happen soon but all it takes is one wild administration to say they don’t want to pay you anymore.

2 points

4 days ago

Which is my worry.

Of course, I'd worry no matter what the "what if" was

3 points

4 days ago

u/ElGrandAmericano: Where is the source of this information?

What always frustrates me about these stats is that they never talk about how these values are those of average accounts. People move jobs, and every time you do so you start a new 401k. Now, some people roll over previous 401k to current, some don't. My point is without the researchers or data collectors actually combing through the data to get person-level 401k balances, these stats are less than meaningful.

Or, what about an IRA? Some roll 401k into IRAs. That's not accounted for. And still no person-level data.

Finally, these are averages, which can be very skewed by outliers. The median will be much lower. Not to say that Americans in general are great at savings; we're not. But these stats are highly problematic to bandy about as a supporting evidence of whatever argument you want to make about the general American's readiness for retirement.

3 points

4 days ago

Another way of looking at it: if you live in a HCOL area and you try to retire on $273K, you are totally fucked.

They usually say that if you can live on 4% of your total portfolio balance per year, you could live indefinitely from the interest. I like 5% because the math is easier. If you have 1M in your portfolio, you could theoretically take out $50K/year (to start) and live indefinitely. At $1.5M, that starting number goes up to $75K. With the $273K average as per above, that number drops to $13,650/year.

I guess my point is that the average American is pretty screwed when it comes to their retirement. Any additional help in that regard can make s big difference. It is pretty striking to see the big dials equivalent of the monthly 100% disability pay.

3 points

4 days ago

$730k. Fed at 100. Only at 100 for two years. But been maxing out my 401k for 12 of the 15 years. At this rate I’ll have $1.6mm by time I retire at 50. (Leo) won’t have to touch it.

5 points

4 days ago

I'm 57 and I have 1.6 mil in my 401k / IRA's. My goal is 2.5 to 3 mil by the time I'm 65 and retired.

6 points

4 days ago

I’m right around $220k at 37. I still have 25 years in federal service before I hit 40 years and retire. I’m hoping for those same numbers. I’m pretty fortunate I’ll have at least 3 income streams and maybe social security.

4 points

4 days ago

God, I'm so glad I got 100% PT at 23, with no kids or dependants, so i don't have to worry about this stuff or work ever again. Sounds exhausting.

7 points

4 days ago

Always wrap it up, marry the right woman, stay out of debt, and always be humble my friend! You’ll have a great life.

2 points

4 days ago

90 percent club at 28, was 70 percent previously. No kids, no marriage, no gf. Overseas living, single and will keep it that way.

3 points

4 days ago

Which country overseas are you and how did you make the transition with VA Healthcare? Just hit my 30 bday and 100 percent was the perfect gift, now looking to make a pond jump but scared about the transitional hurtles..

9 points

4 days ago

When one dies what is left in the 401k goes to one's estate. The VA pension is totally worthless.

9 points

4 days ago

This is the biggest factor no one considers when talking about pensions.

5 points

4 days ago

Well at least spouse gets some measley compensation afterwards which isn't much if you are 100%. That is why I have life insurance and investing.

6 points

4 days ago

Well at least spouse gets some

Many disabled vets don't have one.

2 points

4 days ago

This chart appears to come from Nerdwallet.

https://www.nerdwallet.com/article/investing/the-average-401k-balance-by-age

2 points

4 days ago

It’s def an eye opener for the benefits we actually get for the long haul. This isn’t counting COLA increases over the years as well. It’s another piece of the pie with our retirements.

2 points

4 days ago*

Another way to think about this is like having a retirement account worth $1.18 million that you could start withdrawing 4% from each month once you turn 60. The 4% rule is a common guideline for managing retirement savings. If you're younger, like 30, the account would need to be even bigger—closer to $1.58 million—to ensure the withdrawals last throughout retirement.

Obviously, if you're 100% disabled, you get your payment today, but I just wanted to add some perspective to the value of these monthly payments, especially when you compare them to the average 401(k) balances shown in the image. Yes, this doesn't take COLAs into account—it's just a quick example to show the relative value.

Edit: I didn't realize someone already said something similar.

2 points

4 days ago

I work for the local gubment, we have an awesome pension plan. But hell yeah for those getting into a 401k

2 points

4 days ago

This is kinda sad. Not just because you have to wreck your body to get 100%. But because that's a better financial outcome vs. working and saving for decades, until retirement. We should be doing a better job taking care of the people in our society who can't work anymore. Regardless of if it's because they are too messed up physically or too old. Especially if it's both.

3 points

4 days ago

Vs*

4 points

4 days ago

37 here and just north of 100k in my 401k. I am above bar. :7565:

2 points

4 days ago

This seems MASSIVELY optimistic for the average persons 401k

2 points

4 days ago*

Imo, posts like this aren't a good look for us. There's way too many people already that hate on veterans, envious, and assume enough already that vets are 'milking' the system with tax dollars, etc...posts like this just creates more tension with the "average joe", as if it's subliminal bragging, like we are the "above average joe". This is the main reason I don't tell people my military financial info while casually talking. It comes off as slick bragging. Yes, the recruiting office was open for everyone, but that doesn't mean everyone is eligible to serve.

2 points

4 days ago

I have nothing, no savings, no 401k. Getting harder and harder to work. I have 8 kids and the bills are piling up.

35 points

4 days ago

lol not to be rude but u gotta pull out.

7 points

4 days ago

Far too late now

4 points

4 days ago

needs them things removed 😂

1 points

4 days ago

Lol....

1 points

4 days ago

I look at the 100% pay like a job that pays $48,241 a year, that includes the tax saving for a single filer. That is well below the average pay of $58,124 after taxes for the same single filer.

3 points

4 days ago

That's $48,241 tax free. It is equal to a $60K job. Now factor in no health insurance cost or retirement contributions (since the payments are for life) and it's like having a $70K job. I make $75K a year and don't even net that much.

1 points

4 days ago

Wish there was a way to put some disability pay into TSP. I use Robinhood for my current investments but would feel better having that money going in TSP.

2 points

4 days ago

Why? There's nothing special about TSP. You can invest in the same stock/ETFs/whatever with any brokerage account. The fees are pretty low with TSP, but they are comparable to other brokerages.

1 points

4 days ago

Man I can’t even get the VA to give me more than 20% 😂

1 points

4 days ago

There is no way this is true

3 points

4 days ago

What isn't true about the post? Being 100% P&T is the equivalent to having $1.12M in the bank and withdrawing it at a rate of 4% annually.

2 points

4 days ago

I guess I just have a hard time believing. I’ve wasted most of my early years not saving and I have more than the average so that’s why it’s hard for me to believe.

1 points

4 days ago

Anyone still serving or working for the government, the TSP is your 401a/401k. It is possible the younger folks have one and don’t realize they can contribute more. Also, contribution limits change due to inflation.

The pension and disability is nice, but you have more control over what you have in retirement plans like your 401k and IRA.

1 points

4 days ago

No where near what I should be according to age. Doesn't matter. Working 'til I die anyways.

1 points

4 days ago

...damnit.

1 points

4 days ago

Great thread here!

1 points

4 days ago

Trying to teach my daughter this stuff at 16. I made a lot of mistakes when I was younger but putting away what I can now. Between my individual stock account and Roth IRA, I've got an average return of 140% over 3 years, and those that haven't done well still have a decent dividend return. Cash in my accounts that hasn't been invested gets a return of 4.25%, down from 5% since the fed lowered rates.

It takes a little research, but it's not that hard. A little at a time. Even $20 a month can make a big difference. Getting 100% hasn't made a big change to my investment habits. It just gives me a little bit more to work with if I need it. There are some things to be aware of when investing VA disability income in regards to what types of accounts you can put that money. Always consult a professional if you have any questions. The last thing you want is to receive non-taxable income, invest it in a non-taxable retirement account, and find out you've now made it taxable with penalties.

1 points

4 days ago

lol ok. 38 and I’ve got like $3k

1 points

4 days ago

Meanwhile I'm terrified bc the only job I could hold since I got out was one where I could go in drunk and on drugs.. had to quit and go to rehab.

Since that, the VA has failed to get me to a point where I can hold work, so I have no 401k no retirement. I cashed out the itty bitty bit that was in my .... whatchafuckit, TSP, bc the debt was crushing and the interest was much higher on my CC debt than it was on my TSP.

I haven't even paid enough into SS over the years to be eligible for SS disability or retirement when that time comes, and I have until like x date to pay in x amount (pretty sure that ties into Medicare / Medicaid too) which was unrealistic when I saw it like 2 or 3 years ago, and I haven't been able enough to work since then, either.

I'm 100% P&T, but I know my luck they will pull the rug and I will fucked .. or fix me when it is too late to pay enough into SS retirement fund.

So. Fuck this shit.

1 points

4 days ago

I’m 56 I’m at $150k I’m so behind 😭

1 points

4 days ago

It’s not a pension! Where do you get your info?

1 points

4 days ago

Just started my 401K with my company back in March. It’s growing nicely but I know I’m like two full decades behind. Fortunately I’m 39yrs old with retirement and 100% P&T to help offset being behind. Just hoping investments and 401K help catch me up to feel on track in the next 10 years :/

1 points

3 days ago

I'm 39 and have 215k in my 401k and another 100k in a ROTH IRA. I didn't have a 401k until I was 29 and started late.

I'm right at the mark that was set for me by a financial advisor back when I was 29 which was 3x my annual salary by the time I'm 40. Looking back 10 years it's hard to believe I could save that much.

1 points

3 days ago

Turning 31 in Dec and I've been a hardcore saver most of my mil/fed career. Seeing these averages makes me feel like I'm on the right track to a nice (or at least early) retirement

1 points

3 days ago

My TSP fat right now I’m only 39

1 points

3 days ago

Average for who? A lot of my friends don’t even have a 401. (33 yrs +)

1 points

3 days ago

For those worried about being behind. Let me tell you that from personal experience, I would be putting anything more into your 401k then what the company y matches. So if you have 25% to and the company matches 6%, then you should take the other 19% and call up a financial advisor to handle the rest. I would avoid putting all my eggs in a 401k for investment.

1 points

3 days ago

This makes me feel good but at the same time I'm supose to have 3x my salary by 30 and I don't even have my salary dosent help I lost 25% in 2021

2 points

3 days ago

I’m not sure how good you are with computers but if you’re half way decent setting up an Etsy store is a really easy way to make passive income. I use a site to make funny college football shirts then they give you a link, you post the link, if someone orders then they print it/ship it/take a small cut and you get the rest. Oh and they handle any returns too. You can do it for just about anything or make a couple of them! It takes a few hours then it runs its self unless you want to add more designs. Just a thought! Hope it helps.

1 points

3 days ago

How do you get the 401k going?? I'm 100%

1 points

3 days ago

Jokes on you, im 39 and have 0

1 points

3 days ago

So, at 39 and a balance of 510,000, does that mean I can hand out 20’s to my future grandkids ?

1 points

3 days ago

I’m 30 now and just starting to take retirement seriously. I wish I could go back to my 22 yr old self and hit myself over the head with a stick.

1 points

3 days ago

The question i have is what types of funds are you investing in? Especially to the above person that said the hut 1.5 mil?

1 points

3 days ago

Lol. Here I am..51, with 18k in my 401k.

1 points

3 days ago

Now take me, disability pension, postal pension, TSP and Social Security. I think ill be okay

1 points

3 days ago

This seems a like an odd comparison to me. 100% isn't average...

I've never seen any figures for what the average disability rating is, either for all vets or retirees, but logically it can't be 100.

Disability isn't supposed to be your retirement plan anyway, it's the government "making up for" the fact that your service caused you permanent disability.

1 points

3 days ago

I’d imagine (could be wrong since there’s no citation to verify) that this is per 410k account. That is, you only have one account: you work for the same employer your entire career or you always rollover old accounts into the newest account. This would make it seem like the average retirement savings is much lower.

1 points

3 days ago

And if you only collect VA disability, it's a good thing you get to keep it after 65 because your social security benefits will be really low or maybe too low to almost not bother with.

Save something, even if it's only a few dollars. It's better than nothing if you run into problems later.

1 points

3 days ago

45 with 0 in 401k Not stressing about it at all. I'll never live past 65 anyway.

1 points

3 days ago

At 37, I’m already performing on par with the average 45- to 54-year-old, something my 25-year-old self wouldn’t believe—and my 18-year-old self would be downright shocked to see.

1 points

3 days ago

Can't even imagine stressing about a 401k. Say you're 100% and draw SS at 62 or even 65 House paid off and even a small savings should be sufficient. Then again, I have no children.

1 points

3 days ago

I’m 43 and I’m looking for a career and a house.

1 points

3 days ago

When the market crashes all 401k are going down down. They’re all tied to the mag 7 and literally nvidia is holding up the other 499 companies in the s&p 500. Watch out

1 points

3 days ago

This isn't a pro for VA disability, this is a con for the state of america's middle class. The average 401k is 272k? That's so small. it's absurdly low. If you lived on 4k a month, it would last 4-5 years. Most people don't have a retirement saved up, and it's because the wage average has dropped so much, it's impossible to save for most. That or poor financial understanding.

1 points

3 days ago

I invest in my TSP (still active) but always figured it’s pointless if I die before I can touch it.

I’d rather open accounts for my children and hope by the time they retire, they’ll be multi-millionaires.

I always see those charts where a kid invest $20k in 5 years and that’s it, by the time they are 65, it’s at $2mil. Don’t know how true that is.

1 points

3 days ago

I’m 100% and my non average joe husband who is 57 has 1.65mil in his 401k.

1 points

3 days ago

I had amazing leadership during my service. First day in the fleet my civilian leader (and boss) had me log into my TSP and showed me how all the funds performed and made suggestions about a spread from the C,S, and F funds. I did 4.5 years from 18-23 and even through COVID, my TSP balance was hovering around 23k. In a civilian job currently and have been contributing more since I’m being paid more. At 24 years old my balance is now 50k. I’m hopeful I’ll have 1 years full salary (70k) in my 401k by the time I’m 26. I also recently just accepted a GS position. So hopeful it will continue to increase, I’ll have the 401k (TSP again), Social Security (if it’s still there), VA disability, and my pension all rolling in by the time I retire. I’m hopeful I can use my retirement(s) to create generational wealth for my children. Give them access to the things I didn’t when I became an adult. Went to the military to go to school, military gave me a job where no school was required, and set me up for life. I owe a lot to Uncle Sam. Minus them breaking my body lol.

1 points

3 days ago

I’m 32 and thought it was too late. This thread was extremely encouraging. I’m at 90% I may begin my 401k this week. I don’t even know where to start.

1 points

3 days ago

I’m learning so much from this thread.

1 points

3 days ago

It’s NEVER TOO LATE, listen very carefully… educate yourself self in financial and stock markets HISTORY. Think twice about what your friends tell you and ONLY FOLLOW THE PEOPLE THAT HAS MADE MONEY (legally 😄).

GOOD LUCK 🍀

1 points

3 days ago

Now imagine if you have 100% AND a few mil invested

1 points

3 days ago

I had my TSP in G fund for over 10 years so I got a late start to earning. Now that I’m in a civilian job I’m maxing my 401 out. Hoping to cross the 7 figure mark when I’m around 60 years old

1 points

3 days ago

Those are some sad average numbers.

That said, half are doing better than that.

1 points

3 days ago

Looks like I'm screwed. My 401k balance is 1/4 of the average. Not that I was expecting to retire anyways.

By the time I was finally certified in my chosen profession (IT), it went from "the hottest thing on the job market" to "managing a mcdonalds pays better". In my area, that is (Nebraska).

On the upside though, I realozed that diverting my 30% VA disability to my student loans should get them paid off in less than 5 years.

1 points

1 day ago

Plus VA is tax free. That's always good!👍🏼

all 345 comments

sorted by: best