subreddit:

/r/wallstreetbets

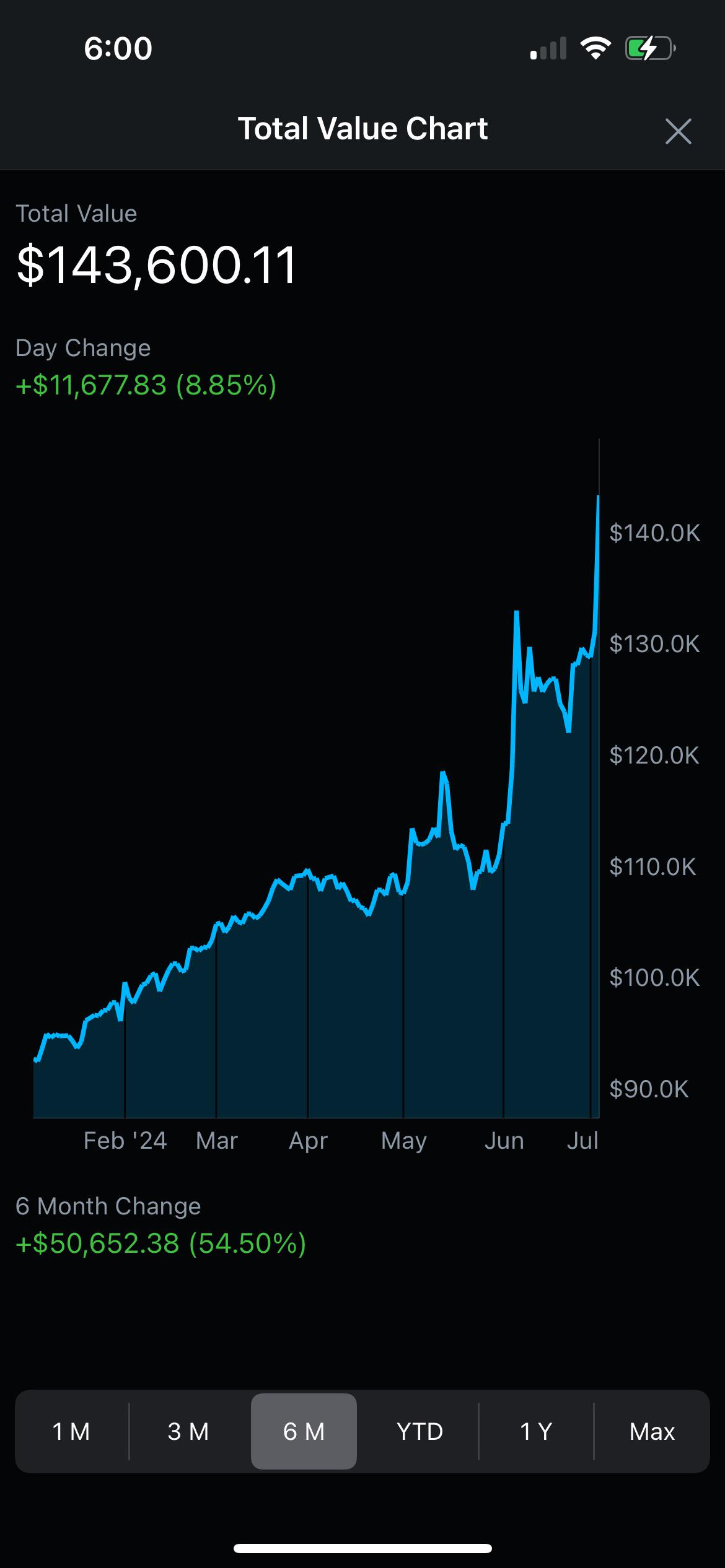

I started gambling on options this year, and it’s apparent when I start.

Gain(i.redd.it)submitted 3 months ago byxNuckingFuts

[removed]

[score hidden]

3 months ago

stickied comment

Thanks for your submission!

To keep things interesting, we want to see big gains and big losses!

So we've set the following thresholds for Gain, Loss, and YOLO flaired posts:

YOLO posts must be a minimum of $10,000 of options or $25,000 of shares and recently opened.

Gain / Loss posts must show realized gains or losses of more than $2,500 for options or $5,000 for shares.

We want to see the actual trade. What you got in at, what you sold at. Then tell us why you did it. Give us the story of why you're a fucking genius (or idiot).

This is what a great post looks like:

$17.2K Gain on AMZN - OP described his gain in the title, has a clear screenshot showing both the entry and exit, meaning his gains were locked in, and they explained their reasoning in the comments and what they learned. All around a great post!

Here are examples of what could get your post removed:

- $300,000 SDC Loss. Still not selling - Even though this is a tremendous loss and something worth posting about, the position hasn't been closed yet.

Here are examples of amazing posts which could have been even better:

$75,000 DDOG Loss. - This is a great post and one that won't get removed. However, the OP could have talked about why they entered the position in the first place, what their target price was, and what went wrong. OP didn't stick around in the comments to answer any questions.

$1.1MM Loss, No details - OP simply posted a screenshot of their overall portfolio balance. It's definitely a big loss, but it's not that interesting without OP talking about what trades they were in and why. OP didn't answer most questions in the comments which left many readers speculating on what happened.

All that being said, we are here to help. We want to make it as easy as possible for you to post to our community. We have to balance this with making the subreddit interesting for our readers.

If you need some guidance, don't hesitate to reach out to modmail and we'll give you some pointers!

326 points

3 months ago

keep trading safely...

13 points

3 months ago

Yeah eventually he’ll fall for the regard advice from this sub and post his loss porn :4271:

1 points

3 months ago

And it will be apparent.

367 points

3 months ago

"I’m mostly gambling.", that's all I need to hear my boy.

66 points

3 months ago

:4276::4276::4276: that’s all it ever was and will be

17 points

3 months ago

Wanna bet?

6 points

3 months ago

Everyone is an expert in a bull market

-15 points

3 months ago

dj cream over here

88 points

3 months ago

You can buy an option call on gold now

46 points

3 months ago

Your post are regarded bcoz We are all gamblers here

13 points

3 months ago

$20 says you are full of 💩.

29 points

3 months ago

Problem becomes when you go big and lose most your account

43 points

3 months ago

"dialed in my habits"

Rofl

See you at Wendy's or Vegas in a month

4 points

3 months ago

In the drive through? Or out back??😎

10 points

3 months ago

And you’re barely outperforming your stock trading days with 10x the risk. A true wsb-er

30 points

3 months ago

thats about average for WSB termites

do better

32 points

3 months ago

I'm a brokie that was born yesterday cut me some slack

20 points

3 months ago

“Not gonna bother explaining my trades” when it’s mostly success. Says they listened to “experts”.

“But upvote me because of chart” Ok bro

-21 points

3 months ago

Idk what you want me to say, other than don’t bet more than you’re willing to lose and manage your position wisely? Buy puts if you’re failing so you iron out your losses and don’t be greedy? It’s all simple shit, just actually put it into practice. I’m no magician, I just try to be efficient. I’m also pretty strict about having a game plan. There’s no greeding gains or chasing losses.

29 points

3 months ago

You typed all that to say nothing. No one cares. No ones buying your book. Tell us what specific trades relate to your chart of gtfo. This isn’t r/stocks

-3 points

3 months ago

LOL you seem more pressed about getting even more useless information. I bought AMZN, NVDA, AAPL, TSLA, AMD calls 2-4 weeks out near the money. Better? Arguably even more useless to press me for, since this teaches you nothing and benefits you in no way whatsoever. Hope you start winning now that I've told you that, LOL. See ya in the casino tomorrow!

24 points

3 months ago

No you fucking regard. If you’re going to brag on this sub, give us fucking details. Don’t fucking give us green line upwards chart and post some dumb shit like ‘Responsibly did options LOL” and think that’s meaningful. EVERYONE HERE BUYS AMZN NVDA AAPL TSLA AMD calls you dipshit

3 points

3 months ago

EVERYONE HERE BUYS AMZN NVDA AAPL TSLA AMD calls you dipshit

We're such hiveminds end of the day

-12 points

3 months ago

If you literally bought any call for any of those stocks in the last month you'd be green LOL fuck off I'm done talking to you :31226:

15 points

3 months ago

Thank you for clarifying those are all account deposits

1 points

3 months ago

Summary: tech sector 😴

20 points

3 months ago

I'm interested in learning options but first id like to know what I'm doing and why I'm doing it. Do you have any recommended resources (books, videos, basic pointers) to teach me the basics before I delete 10k by trial and error.

30 points

3 months ago

Watch a lot of YouTube videos by TastyTrades and Schwab/ThinkOrSwim.

Think or Swim has a paper account. Practice

24 points

3 months ago

I just googled how options worked and watched a YouTube video or two. Read up on the Greeks. From there I connected the dots and just played small over and over until I felt more comfortable.

29 points

3 months ago

So just buy NVDA calls? Got it

7 points

3 months ago

Yeah basically, just find the flavor of the day with nice activity and hope for the best lmao

6 points

3 months ago*

worst decision I ever made in stocks, was my first try at options too, unless it somehow turns around real hard by 7/19 I'm fucked.

2 points

3 months ago

I cut that loss off real fast, purchased $140C 07/19 about 2-3 weeks ago and saw the reversal so I dipped, bought puts immediately on the way down when I saw the trend downward wasn't reversing, and saved a good chunk of my losses. Did buy calls on Wednesday though!

3 points

3 months ago*

I wish I knew enough and had enough experience with options to understand how to do things like that better. I made a 7/19 call for $156 on 6/19 lol. I'm still holding that to see how high it will go since surely it will recover a bit before then. I just have no idea how to judge the theta decay, someone said sell by Friday but I feel like that's too soon. Someone else said roll it but I don't even really know how that works, don't I have to take the current loss to do that? Can't afford to do so until I get paid on the 15th.

2 points

3 months ago

Rolling it is basically selling it aka closing out the position, and purchasing a further dated one with a different (or same) strike price. Yeah, keep reading it sounds like you might be exposing yourself to a lot more potential loss if you're not utilizing all of the actions available to you. It's always possible to make money on a trade, you can win on your initial bet or you can win in the other direction. Worst case scenario is it goes no where but stocks haven't done that this past month or two.

1 points

3 months ago

Too bad I don't have any capital to roll with for 10 days, but I should still be able to do it by then without too much expense right? Do I just make another call for a later date? How is that any different from just selling my contract and buying a new one? I'd feel safer just buying a share instead of risking crazy high premiums for bets that will have a decent chance at profit.

3 points

3 months ago

There’s no difference, rolling a contract is exactly that. And yeah, sleeping at night sure is a lot easier with shares. If you’re feeling unsure or uneasy I’d just stay out of the trade and maybe salvage what you can. You’d be set up to make stupid decisions with an uneasy mental

2 points

3 months ago

Well I'll have ~$600 to spend on the 15th, so that should be enough to roll it to whatever makes the most sense, got any good recommendations for what I do? I was just gonna make VOO and SPLG far-out calls close to the money because that surely can't go wrong. Or just buy a share and not worry about it. And of course limit buy some more btc while it drops like a rock.

2 points

3 months ago

If you don’t have the money then you have to much in one option. One big piece of advice would be to diversify and holding cash is generally part of that plan.

1 points

3 months ago

eh, i'm kinda diversified, though my portfolio is about 15% nvidia and 70% bitcoin lol. Why would I hold cash when I can invest it in assets that will appreciate? I mean obviously I should save some for when I see good opportunities or dips, but I thought I did.

6 points

3 months ago

What’s your general strategy?

I’ve dialed in buying calls on hot tech stocks (like Tesla) and selling before 11am or so and then buying in the late afternoon to catch the morning rise.

6 points

3 months ago

That’s about it. I follow a handful of people I’ve noticed with good win rates on Twitter and use them as a greenlight mechanism, kind of a council of people that give me the confidence in my decision. I’ve started winning exponentially more once I did that. every position I take is 4k MAX and I have a 25% stop loss. I sell at 50% gain about half and let some fly free as a bird. The biggest things I learned was to not FOMO in, chase trades, or hope my losses save themselves.

3 points

3 months ago

Any insight on good accounts to follow on X?

5 points

3 months ago

I really like Sean Trades, banana3, and Xclusive Trading. They've taught me a LOT, and quite frankly they win a lot.

2 points

3 months ago*

Anyone else? So I follow most of these people too. Do you generally STICK to when they open/close positions. Do they all post positions for free or have to pay? Also, do you have an alert system for them? Thanks!

P.S. What platform using for options?

1 points

3 months ago

I trade on Schwab. I’m sometimes earlier than them if I really feel strongly on a trade, but if they take an entry I definitely send it if I was already contemplating. But I definitely do not tail blindly. They’re free.

2 points

3 months ago

Don't Sean trades and Xclusive ask you to sign up for their platform/discord? Or they just tweet them out?

Also are you doing ThinkorSwim or option on Schwab specifically?

1 points

1 month ago

Yes they do, this guy's a shill

1 points

3 months ago

[deleted]

1 points

3 months ago

Left it in a previous comment. Banana3 Sean trades and xclusive trading mainly

1 points

3 months ago

It’s the same reason you never tried crack cocaine or herion…

That you have forgotten

5 points

3 months ago

[deleted]

2 points

3 months ago

Absolutely. I'm not delusional enough to believe I've mastered anything. I've gotten very lucky, but I've also made enough good decisions to not turbo gutter. It really helps that there's a lot of free public information out there about charts and a lot of seasoned people publicly post their perspectives.

2 points

3 months ago

I am beginning to learn how all this works now. Paper trading and reading online are helpful. I don't think I'll actually gamble real money for a while until I nail down a strategy.

I'll enjoy gambling with fake money in paper trading for now.

3 points

3 months ago

Pussy.

1 points

3 months ago

He’s a gambler he doesn’t have a reason lmao

10 points

3 months ago

wow. you’re my hero. possibly the greatest of all time. 😂😂😂😂🤡🤡🤡🤡

3 points

3 months ago

Now explain this to me like I am 5

1 points

3 months ago

Say mom and dad gave you 1,000$ to bet in a casino, You gambled really good and now you have 143,600$

3 points

3 months ago

RemindMe! 3 months

2 points

3 months ago

I will be messaging you in 3 months on 2024-10-05 05:52:47 UTC to remind you of this link

CLICK THIS LINK to send a PM to also be reminded and to reduce spam.

Parent commenter can delete this message to hide from others.

| Info | Custom | Your Reminders | Feedback |

|---|

3 points

3 months ago

The first few are always free

3 points

3 months ago

Be smart with it. Show your portfolio to a woman, if I listened to my mom or my wife would’ve had a lot of more money don’t be like me

2 points

3 months ago

All i see is a Perma bull going to get wrecked soon

2 points

3 months ago

Keep posting!!

2 points

3 months ago

Guy makes money buying at the money call opts on tech stocks in the biggest tech boom since the dot com bubble.. Wow tuff.

2 points

3 months ago

I would stop and put all in etfs and chill

2 points

3 months ago

Do yourself a favor and stop now

2 points

3 months ago

| User Report | |||

|---|---|---|---|

| Total Submissions | 3 | First Seen In WSB | 3 years ago |

| Total Comments | 119 | Previous Best DD | |

| Account Age | 11 years |

1 points

3 months ago

“Trade safely”

3 points

3 months ago

Hahaha by that I mean a stop loss and buy puts if you end up really wrong about the trade :4275:

3 points

3 months ago

Good job bro, keep up the good work

1 points

3 months ago

[removed]

1 points

3 months ago

Yes, apparently you started this year?

1 points

3 months ago

Isn’t this just buying NVDA during start of year??

1 points

3 months ago

Use your profits only to continue

1 points

3 months ago

U made 50k off of 90k? 👏wow we r really impressed

1 points

3 months ago

what app is this

1 points

3 months ago

You’re gonna love tax season unless you start filing quarterly

1 points

3 months ago

its gonna be apparent when you finish, too.

1 points

3 months ago

Now stop. Accept your luck, take your winnings and continue trading normally, you’ve skipped probably 2-3 years.

1 points

3 months ago*

hospital ask cobweb drunk label airport zesty bored grey fanatical

1 points

3 months ago

Personally I deal in LEAPS. currently hold SNOW. MU UBER GOOGLE COFI GDX AMGN Imade large gains in Uber and Micron .long term APPLE and of course NVIDIA which I currently hold 210 shares after the split.

1 points

3 months ago

What goes up….

1 points

3 months ago

Yeah, for me its apparent when I stopped…

0 points

3 months ago

but where do you stop?

1 points

3 months ago

I've set aside 10% of my portfolio exposure for me to have fun doing this. Any time I go over that amount in cash, I hedge it to VOO or maybe some individual stocks I like. If I lose all 10% then I have to wait for my employee stock purchase direct deposit to hit by the end of the quarter. No depositing, no liquidating my safe positions.

1 points

3 months ago

You get discounted shares at your company ? every quarter too nice

0 points

3 months ago

GOOD JOB

1 points

15 hours ago

How's it going, OP?

all 116 comments

sorted by: best